Cap Rates and Loans

Multi-family Cap Rate Reduction;

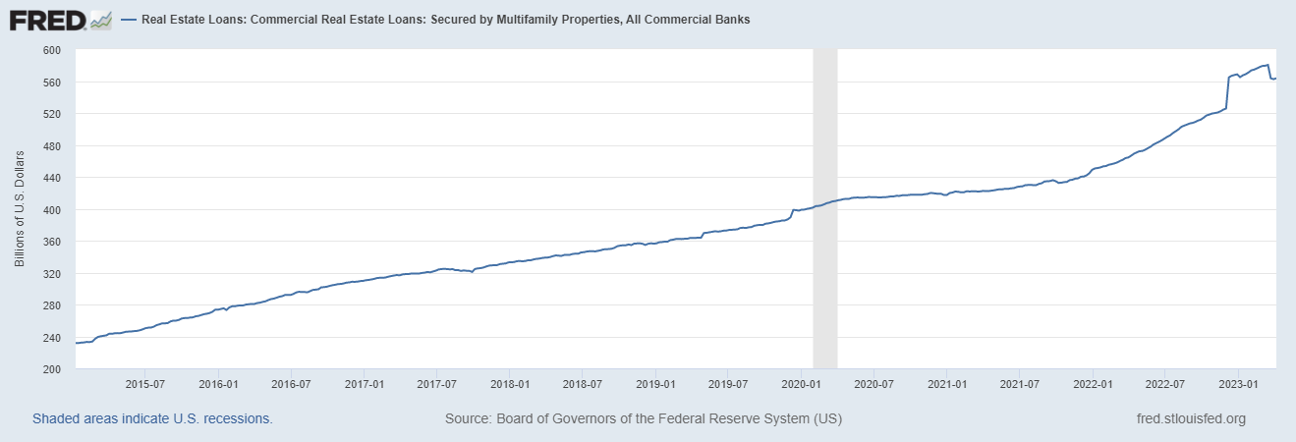

The last 8 years have seen tremendous loan growth to the multi-family sector.

https://fred.stlouisfed.org/series/SMPACBW027SBOG#

Cap Rates declined dramatically because of:

1. The above availabillity of leverage and cheap capital

2. Demographic shifts and family behavior

3. Investors risk tolerance and

4. Certain government policy decisions

CBRE Q4 2021 Multifamily Cap Rate

A Return to Normal (?):

When cap rates increase and return to a more namalized rate (6-9%?), like they will, it will hurt many of the smaller banks who hold some of these loans on their balance sheets.

The reset of loans (Terms/Rates) in books, rising interest rates, rising cap rates does not present a pretty picture. The damage if cap rates rise to a 300% over the risk free rate would be dramatic.